I had the privilege of being one of the panelists at the #BNIOnline Business Leadership Session discussing Key Financial Considerations for your Business during this #CoronaVirus #COVID19 season.

Both my #MTN Mifi and #Airtel internet connections were not stable, I had to oscillate between the two and am now getting a 3rd internet service provider as a backup of the backup 😀. This is quite frustrating for us who #Zoom almost everyday! Anyway below is a summary of my presentation.

As fuel is to a car so is cash to a business. You can have a very posh or luxurious car, but without fuel how far can it take you? Nowhere

A business can be very profitable but without cash it's operations may come to a standstill.

Practically, we don't open our fuel tanks to check the fuel levels, we look at the fuel gauge..... unless it's a faulty gauge of course

Similarly in business we use a tool to help us determine our cash/liquidity levels and how far we can run with it.

This tool is a cash flow projector. You can use a simple excel spreadsheet for it or an Accounting software which usually would have cash flow projectors inbuilt

Step 1. Evaluate your current cash status. The money in the bank, in your pocket, in liquid assets - Unit trusts, treasury bills, fixed deposits etc that you can easily access in a matter of days

Step 2. List your revenue/income streams. It's advisable to have multiple revenue streams

Step 3. Determine how each stream flows. Some may have stopped flowing, some flow daily, weekly or monthly. Aggregate your total monthly inflows and in which month they will occur in the coming 3 to 12 months

Step 4. List all your obligations and liabilities or planned purchases. Salaries, rent, utilities and other overheads. Loan and supplier obligations

Step 5. Determine when the months when the above outflows will occur in the coming 3 to 12 months. Are they monthly? Are they fixed or negotiable?

Step 6. Plot #3 and #5 against / parallel each other. You can use a spreadsheet for this or any other tool of your preference. Calculate the difference between the inflows and outflows for each month. Remember positive cash balances of previous months can be used to finance subsequent months. When a month is not sufficiently covered, it will be on the RED!

Step 7: Evaluate your possible actions to eliminate all the reds! Some considerations could be; to reduce costs where possible, reschedule payment after supplier negotiations, consider alternative sources of financing to cover essential costs. overdrafts, loans, liquidate idle assets

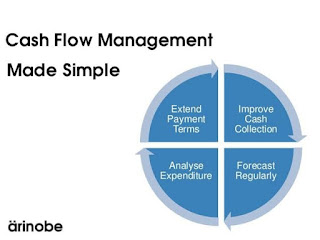

This calls for diligent management and analysis of the business cash flows. Careful cash flow management allows a business to estimate the amount of cash that it will have on hand at any one time, project trends in cash inflow and cash outflow, and evaluate whether a shortfall or surplus in cash could potentially occur.

Cash flow is like oxygen for your business, without it the business will die. A profitable business can still easily run out of cash.

The way you keenly monitor your fuel gauge is the same way you should keenly monitor your cash flow!

The way you keenly monitor your fuel gauge is the same way you should keenly monitor your cash flow!

To your success!

Lilian Katiso

Check TheAccountancyandBusinessClinic Facebook page for more posts

Check TheAccountancyandBusinessClinic Facebook page for more posts

No comments:

Post a Comment